iLL Wink Interview : Da Buket List Ep. 1

Da Buket List sits down with iLL Wink to discuss how he started his DJ journey, discuss no request parties and dance culture in Atlanta IG : @ill_wink

play_arrow

play_arrow

How Amy Liu Built her Sensitive Skin Brand Tower28 at 40 podcast

What It Means to Thrive in This Next Era | Let’s Thrive Together Official Trailer podcast

Saturday, March 7, 2026 podcast

🎙️ Demetrius Beasley of Red Hands Talks New Song “Walking” | Real Gospel with the X-Man podcast

Friday, March 6, 2026 podcast

play_arrow

play_arrow

Ep 223: “Compatibility of The Vices” (Feat Ebony Dukes) podcast

play_arrow

play_arrow

Grief That Accompanies Growth podcast

play_arrow

play_arrow

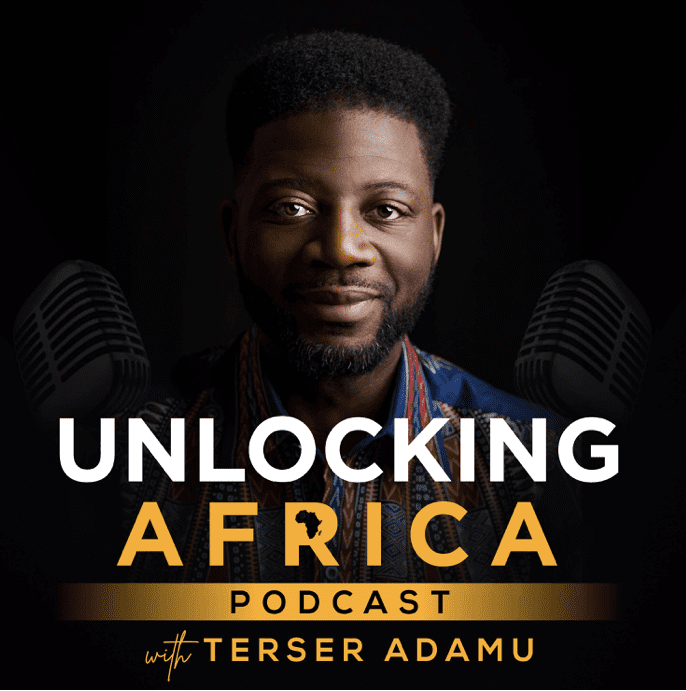

Episode 128 with Ibrahim Toyeeb Ibitade, co-founder and CEO of Leatherback, on his remarkable journey as a fintech founder and entrepreneur and the driving force behind his mission to transform global financial access for individuals and businesses.

Driven by the need to enable global financial access, payments, commerce, and lifestyle opportunities through more equitable financial solutions, Ibrahim started Leatherback in 2019 with an ambition to democratise banking by providing a single access point that empowers individuals and businesses to think and act globally.

Leatherback is a global banking service provider for individuals and businesses, with innovative technology solutions that unlock equal opportunity for borderless global trade and commerce. Users can access more than 15 currencies from 21 countries, including NGN, GBP, INR, EUR, USD, and many other currencies.

What We Discuss With Ibrahim

Did you miss my previous episode where I discuss Building a Long-Term Payment Infrastructure in Africa That Removes Currency Friction and Accelerates Economic Growth? Make sure to check it out!

Like this show? Please leave us a review here — even one sentence helps!

Connect with Terser on LinkedIn at Terser Adamu, and Twitter (X) @TerserAdamu

Connect with Ibrahim on LinkedIn at Ibrahim Ibitade, and Twitter (X) @ToyeebIbrahim

Do you want to do business in Africa? Explore the vast business opportunities in African markets and increase your success with ETK Group.

Connect with us at www.etkgroup.co.uk or reach out via email at info@etkgroup.co.uk

Da Buket List sits down with iLL Wink to discuss how he started his DJ journey, discuss no request parties and dance culture in Atlanta IG : @ill_wink

Copyright Blackpodcasting 2025