Road to PMU Millions with Sheila Bella

In this powerful episode of the CEO Glow Show, Sheila Bella opens up about her accidental journey to becoming a multi–seven-figure entrepreneur in the beauty industry. From nearly quitting to […]

play_arrow

play_arrow

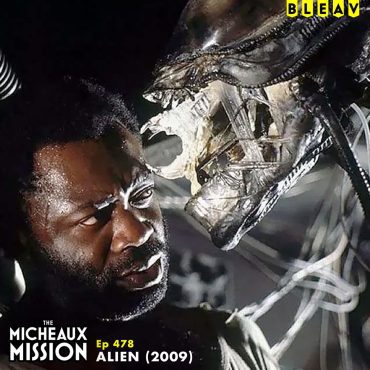

Alien (1979) podcast

play_arrow

play_arrow

K. Miller – 2.25.26 podcast

play_arrow

play_arrow

Game-Changing Marriage Wisdom From the 2026 MIC Marriage Conference, Part 1 podcast

play_arrow

play_arrow

Ep. 226 “Why Being Blocked Hurts So Much (Even When You Don’t Want Them Back) podcast

play_arrow

play_arrow

Tombstone – 2.24.26 podcast

1996 Hip Hop Series: Jason England on Biggie’s Blueprint: The Hidden Impact on Jay-Z & Nas | 02.24 podcast

The New Rules of Investor Credibility with Dominic Forth, Ep. 781 podcast

play_arrow

play_arrow

Pascal Wagner is a former venture capitalist turned real estate investor who has built a $250,000 annual passive income portfolio through over 30 investments. As a VC at Techstars, he deployed $150 million into 300 companies, where he learned how top institutions analyze deals and manage risk. Today, he applies that same institutional approach to passive real estate investing while coaching others to invest with clarity and confidence.

Make sure to download our free guide, 7 Questions Every Passive Investor Should Ask, here.

Key Takeaways

Most passive investors make the mistake of analyzing deals in isolation instead of starting with a clear investment thesis.

Institutional investors use a scientific method—macro themes first, then micro criteria, then deal selection.

Diversification is essential: Pascal built co-living homes in Atlanta but realized his mom’s retirement couldn’t rest on one asset class or city.

Following institutional or family office investors can provide a safer entry point for LPs.

Separate your “cash flow bucket” from your “equity growth bucket” to align investments with goals.

Topics

From Techstars to Real Estate

Built early wealth through co-living rentals before joining Techstars as an investor.

Learned institutional-level due diligence by reviewing thousands of deals.

After his father’s passing, managed his mother’s retirement income and shifted focus to reliable passive strategies.

How Institutions Invest

Define a thesis first, then filter deals that fit.

See hundreds of opportunities before investing in a few.

Don’t chase returns—find inevitable long-term trends and align investments accordingly.

Developing Guardrails for LP Investing

Criteria like vintage, roof types, and market selection come from experience and costly lessons.

Partnering with operators who have already learned those lessons is critical.

Institutional investors demand reporting, audits, and controls—retail investors can “follow” their lead.

Buckets of Cash Flow vs. Equity Growth

Co-living homes and private credit provide stable cash flow.

High-risk equities (tech stocks, crypto) are placed in long-term equity growth buckets.

Structured his mother’s long-term holdings for inheritance tax advantages while using his own portfolio for near-term cash needs.

📢 Announcement: Learn about our Apartment Investing Mastermind here.

Round of Insights

Failure that set Pascal up for success: Investing in Jamba Juice stock as a teenager and losing most of his savings, pushing him to become a smarter, disciplined investor.

Digital or mobile resource: Passive Investing Starter Kit, a free weekly email with curated deal flow.

Book recommendation: Atomic Habits by James Clear.

Daily habit: Planning his day the night before.

#1 insight for building a passive income portfolio: Find someone who is already doing it, and learn from them.

Favorite restaurant in Miami, FL: Shiso.

Next Steps

Download the Passive Investing Starter Kit to access Pascal’s curated deal flow.

Connect with Pascal on LinkedIn.

Listen to him Thursdays on The Best Ever CRE Show.

Thank you for joining us for another great episode! If you’re enjoying the show, please LEAVE A RATING OR REVIEW, and be sure to hit that subscribe button so you do not miss an episode.

In this powerful episode of the CEO Glow Show, Sheila Bella opens up about her accidental journey to becoming a multi–seven-figure entrepreneur in the beauty industry. From nearly quitting to […]

Copyright Blackpodcasting 2025