-

play_arrow

play_arrow

Source: Trump Has Reviewed Attack Plan But Is Holding Off For Now podcast

-

play_arrow

play_arrow

-

play_arrow

play_arrow

Iran, Israel Trade Attacks As Trump Weighs U.S. Strikes On Iran podcast

-

play_arrow

play_arrow

-

play_arrow

play_arrow

Trump Leaving G7, Directs Team To Convene In Situation Room podcast

-

play_arrow

play_arrow

Best Of (Rams threat level to Eagles + NFC North Panic Room + Trust Pacers or Thunder more?) podcast

-

play_arrow

play_arrow

Sirens Sounding In Israel Amid Warning Of New Wave Of Iran Missiles podcast

-

play_arrow

play_arrow

-

play_arrow

play_arrow

-

play_arrow

play_arrow

Twin Black Designers Break Silence on Church Burnout, Gender-Free Fashion & Fight for BlackBoyJoy podcast

- Home

- keyboard_arrow_right Entrepreneur

- keyboard_arrow_rightPodcasts

- keyboard_arrow_rightBusiness

- keyboard_arrow_right Navigating Recessions and Building Confidence in Trading

Navigating Recessions and Building Confidence in Trading

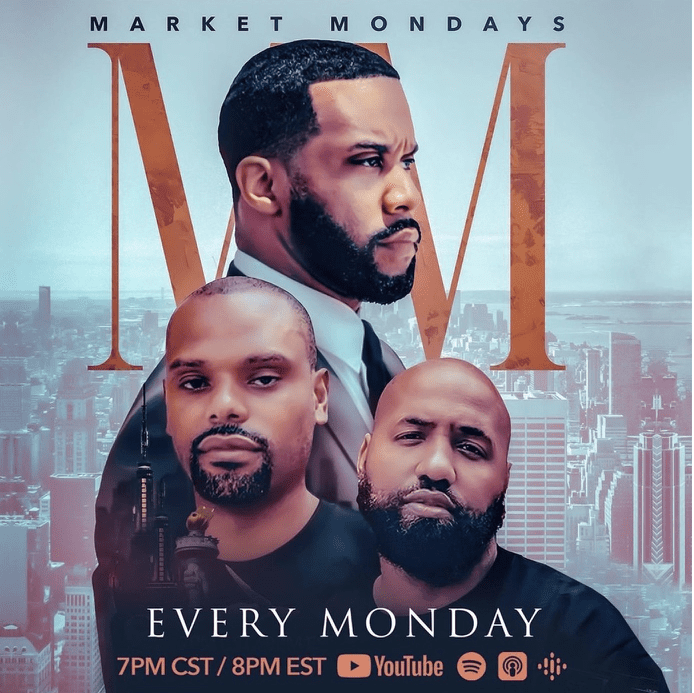

In this clip of Market Mondays, hosts Rashad Bilal, Ian Dunlap, and Troy Millings dive deep into current market trends, investment strategies, and practical tips for both novice and experienced investors. Covering a range of topics from the impact of declining lumber futures to the evolving definitions of a recession, our hosts offer valuable insights to help you navigate these challenging economic times.

The clip begins by addressing the significant decline in lumber futures, the decrease in yields, and the slowing down of the M2 money supply. Ian Dunlap emphasizes the market's inherent bias and how it is strategically manipulated to avoid long-term recessions, suggesting that a traditional recession is unlikely in the next four to five years. He advises investors to diversify their portfolios by investing in assets like Bitcoin, Apple, and Microsoft while cautioning against heavily trading lumber futures and recommending alternatives like crude oil and gold.

Rashad Bilal poses a critical question for investors: How can they build confidence in trading or making stock purchases post-recession, even after thorough research and preparation? Ian Dunlap responds with straightforward advice: engage with reliable sources of investment information, including the Red Panda community and Market Mondays. He underscores the importance of learning from past episodes and applying that knowledge to current investment strategies.

Troy Millings joins the conversation, emphasizing the need for execution over hesitation. He encourages investors to start small, even if it's just purchasing one share or one contract, and then gradually build confidence through experience. Both Ian and Troy stress the importance of consistency and emotional intelligence in navigating the highs and lows of the market.

The clip also touches on high-profile investment missteps, like those of Cathie Wood, and the lessons investors can learn from them. The hosts discuss the importance of focusing on core investments and not diluting one’s portfolio with too many funds or businesses. They highlight the recent reallocation in technology funds, where Nvidia and Microsoft have overtaken Apple, illustrating how quickly market dynamics can change.

Throughout the episode, Ian, Rashad, and Troy bring a wealth of knowledge and experience, making complex market concepts accessible and actionable. Whether you're new to investing or looking to refine your strategies, this episode of Market Mondays is packed with practical advice and insight to help you make informed decisions in these unpredictable times.

Tune in to Market Mondays Medium #5 and join the conversation on how to build confidence, execute effectively, and make the most of your investments in the current economic landscape.

#MarketMondays #Investing #Finance #StockMarket #InvestmentStrategies #Recession #Bitcoin #Apple #Microsoft #LumberFutures #EconomicTrends #RedPanda #TradingConfidence #FinancialEducation #InvestFest #TechnologyInvestments #CathieWood #Nvidia #ConsistentInvesting

Support this podcast at — https://redcircle.com/marketmondays/donations

Advertising Inquiries: https://redcircle.com/brands

Privacy & Opt-Out: https://redcircle.com/privacy

Most Popular Podcast

Recent Podcasts

Source: Trump Has Reviewed Attack Plan But Is Holding Off For Now

Full Show (Tyrese Haliburton pushing to play + Kevin Durant’s next team + Does Caitlin Clark have a target on her back?)

Iran, Israel Trade Attacks As Trump Weighs U.S. Strikes On Iran

Best Of (Micah Parsons’ negotiations + Tyrese Haliburton thoughts after Game 5 loss + Did Thunder end the series last night?)

Site Search

-

Copyright Blackpodcasting 2025