Windfall

There is a time for everything. A time for scarcity and a time for abundance, but through it all the one constant variable is YOU! And how YOU show up […]

play_arrow

play_arrow

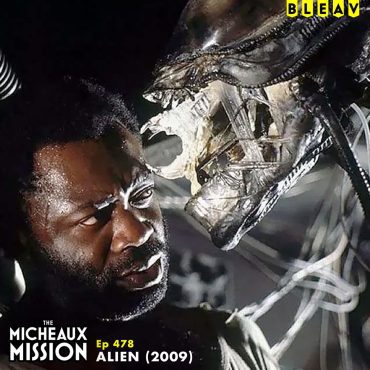

Alien (1979) podcast

play_arrow

play_arrow

K. Miller – 2.25.26 podcast

play_arrow

play_arrow

Game-Changing Marriage Wisdom From the 2026 MIC Marriage Conference, Part 1 podcast

play_arrow

play_arrow

Ep. 226 “Why Being Blocked Hurts So Much (Even When You Don’t Want Them Back) podcast

play_arrow

play_arrow

Tombstone – 2.24.26 podcast

1996 Hip Hop Series: Jason England on Biggie’s Blueprint: The Hidden Impact on Jay-Z & Nas | 02.24 podcast

The New Rules of Investor Credibility with Dominic Forth, Ep. 781 podcast

play_arrow

play_arrow

Ryan Sudeck is the CEO of Sage Investment Group, where he leads a team focused on addressing the affordable housing crisis through hotel-to-apartment conversions. With a background in mergers and acquisitions at Amazon, Samsung, and Redfin, Ryan has overseen more than 24 successful adaptive reuse projects nationwide. Under his leadership, Sage operates an evergreen fund with over 400 investors, creating high-quality, naturally affordable housing at scale.

Make sure to download our free guide, 7 Questions Every Passive Investor Should Ask, here.

Key Takeaways

Hotels are valued differently than apartments, creating a 40%+ value lift when converted to residential use.

Sage Investment Group has completed 24 hotel-to-apartment conversions across six states, with 100–200 units per property.

Units are typically 300-square-foot studios with full kitchens and modern amenities.

Strong diligence on entitlements, construction, and lease-up is critical for success.

Patience in acquisitions—sometimes two years per deal—is key to meeting return thresholds.

Topics

From M&A to Affordable Housing

Ryan’s career in corporate acquisitions prepared him to lead Sage.

Joined as CEO to scale a mission-driven approach to solving the housing shortage.

Why Hotel Conversions Work

Hotels trade at higher cap rates than apartments, creating built-in arbitrage.

Conversion costs average $100K per unit—about half the replacement cost of new builds.

Final product: fully renovated studios with fitness centers, coworking, and community amenities.

Execution Risks and Lessons Learned

Entitlements: converting from commercial to residential requires local approvals.

Construction: inspections, sewer scopes, and cutting open walls before purchase to avoid surprises.

Lease-up: conservative rent assumptions and regional property managers ensure stabilized occupancy.

Capital Stack and Returns

Evergreen fund supplies 25–35% of equity alongside LPs.

Senior debt from community banks or private debt funds covers 60–75%.

Renovation costs run $35K–$45K per unit; recent refis have returned significant equity.

Why Not Ground-Up or Value-Add?

Ground-up costs 2x more per unit and faces supply delays.

Value-add multifamily is overpriced with thin margins post-2021.

Conversions provide stronger risk-adjusted returns.

📢 Announcement: Learn about our Apartment Investing Mastermind here.

Round of Insights

Failure that set Ryan up for success: Holding on to tasks too long instead of delegating, learning that hiring the right people unlocks scale.

Digital or mobile resource: Superhuman (email client), OpenSpace AI for construction tracking, and Athena for executive support.

Book recommendation: Buy Back Your Time by Dan Martell.

Daily habit: Starting each morning with a Kanban board review of personal, professional, and delegated tasks.

#1 insight for commercial real estate conversions: Basis is everything. Be patient, buy right, and don’t compromise on return thresholds.

Favorite restaurant in Seattle, WA: Mbar.

Next Steps

Learn more at sageinvestment.com

Explore opportunities to invest through Sage’s evergreen fund

Follow Ryan and his team’s projects to see how adaptive reuse can scale affordable housing

Thank you for joining us for another great episode! If you’re enjoying the show, please LEAVE A RATING OR REVIEW, and be sure to hit that subscribe button so you do not miss an episode.

There is a time for everything. A time for scarcity and a time for abundance, but through it all the one constant variable is YOU! And how YOU show up […]

Copyright Blackpodcasting 2025