Faith over Fatigue

Never forget the words you declared over your life years ago, and never forget who placed those words onto your heart in the first place

play_arrow

play_arrow

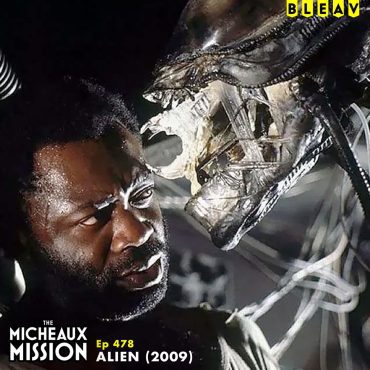

Alien (1979) podcast

play_arrow

play_arrow

K. Miller – 2.25.26 podcast

play_arrow

play_arrow

Game-Changing Marriage Wisdom From the 2026 MIC Marriage Conference, Part 1 podcast

play_arrow

play_arrow

Ep. 226 “Why Being Blocked Hurts So Much (Even When You Don’t Want Them Back) podcast

play_arrow

play_arrow

Tombstone – 2.24.26 podcast

1996 Hip Hop Series: Jason England on Biggie’s Blueprint: The Hidden Impact on Jay-Z & Nas | 02.24 podcast

The New Rules of Investor Credibility with Dominic Forth, Ep. 781 podcast

play_arrow

play_arrow

Chris Naugle is America’s #1 money mentor, a former pro snowboarder turned entrepreneur and founder of The Money School. He has built and managed multiple businesses, authored books on wealth, and now teaches people how to take back control of their finances using the infinite banking concept. Through his methods, Chris has helped thousands of investors and entrepreneurs rethink how money really works.

📢 Announcement: Get 25% off your first two months with Hemlane’s property management software — visit hemlane.com and use the promo code: multifamilypodcast25.

Key Takeaways

Why traditional banking keeps people trapped in financial dependency.

The power of infinite banking and using specially designed whole life policies to grow wealth.

How Chris recovered from financial failure during the 2008 crash by changing his money mindset.

Why controlling the flow of money is more important than chasing higher returns.

Common myths about money and investing that keep people stuck.

Topics

From Snowboarding to Finance

Chris’ transition from professional snowboarding to financial advising.

Lessons learned from losing everything during the 2008 crash.

The Infinite Banking Concept

How whole life insurance can be structured as your own personal banking system.

Why borrowing against your policy allows you to keep your money growing while using it elsewhere.

Why Control Beats Returns

Most people focus on rate of return, but controlling cash flow is more powerful.

The wealthy don’t work harder for money—they make money work harder for them.

Breaking Money Myths

Common misconceptions about banks, debt, and retirement accounts.

Why conventional financial advice often benefits institutions more than individuals.

Make sure to download our free guide, 7 Questions Every Passive Investor Should Ask, here.

Round of Insights

Failure that set Chris up for success: Losing everything during the 2008 market crash forced him to relearn how money truly works.

Digital or mobile resource: Money Multiplier calculator tools.

Book recommendation: Becoming Your Own Banker by Nelson Nash.

Daily habit: Visualization and affirmations every morning.

#1 insight for creating financial freedom: It’s not about how much you make, it’s about how much control you have over your money.

Favorite restaurant in Buffalo, NY: Two Nines.

Next Steps

Learn more at chrisnaugle.com

Watch Chris’ educational videos on YouTube: The Chris Naugle Channel

Explore resources at The Money School

Check out his previous Multifamily Insights Podcast episode

Thank you for joining us for another great episode! If you’re enjoying the show, please LEAVE A RATING OR REVIEW, and be sure to hit that subscribe button so you do not miss an episode.

Never forget the words you declared over your life years ago, and never forget who placed those words onto your heart in the first place

Copyright Blackpodcasting 2025