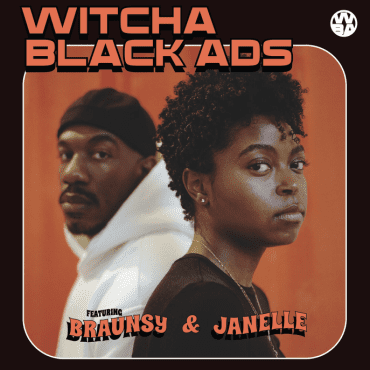

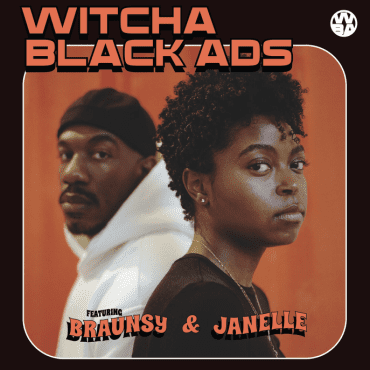

59. Banned & Blasphemous

Kicking off the year with a bang on Episode 59 of Witcha Black Ads! This time, we talk Tiger’s bold move away from Nike, Megan Thee Stallion’s collaboration with Planet […]

play_arrow

play_arrow

BEST OF NFL Week 18 Part 1: SACK KING Myles Garrett, Matt Stafford vs Drake Maye MVP Debate podcast

play_arrow

play_arrow

play_arrow

play_arrow

Deebo & Joe – Steelers Playoff Worries? Will Browns Draft Another QB? + Harbaugh’s future uncertain podcast

play_arrow

play_arrow

[277] Tired of Proving Yourself? A Quiet 2026 Plan for Family Focus and Peace podcast

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

play_arrow

Why do winter holidays always feel like a Sunday? Ep 371 podcast

play_arrow

play_arrow

Week 19 – Bill Belichick podcast

Naseema McElroy is a published author and the founder of Financially Intentional, a platform about personal finance and living life intentionally. Naseema managed to pay off $1 million of debt.

Naseema discusses how taking control of her finances has enabled her to overcome bankruptcy, divorce, and the cycle of living paycheck to paycheck. She shares her lessons along her path to help others benefit from the freedoms of financial independence.

Outside of encouraging people to get their financial act together, Naseema is a mother and labor and delivery nurse. Though making six figures for years, she struggled with money. Finally realizing she couldn’t out-earn her financial ignorance, she knew she had to make some changes. By shifting her mindset around money, being consistent and intentional, she was able to change her financial future.

In this episode, we talked to Naseema about wealth building and helping people kickstart this journey, challenges to paying off her debts, the house hacking strategy and much more.

Announcement: Join the Apartment Investing Mastermind here.

Financially Intentional;

02:29 Naseema’s background;

08:49 Helping people to set themselves up in this journey;

13:40 Where Naseema is at now;

16:24 Challenges she faced while paying her debts;

19:28 Taking the first step on shifting financial behavior;

23:34 The house hacking strategy;

26:55 Round of insights

Announcement: You can check this year’s REWBCON event here.

Round of Insights

Apparent Failure: Her student loans.

Digital Resource: Libby.

Most Recommended Book: Acres.

Daily Habit: Waking up early and exercising, riding her bike.

#1 Insight for being financially intentional: Curating a beneficial circle of influence.

Best Place to Grab a Bite in the Bay Area, CA: CreAsian.

Contact Naseema:

E-mail: financiallyintentional@gmail.com Instagram: https://www.instagram.com/financiallyintentional

Podcast: https://www.financiallyintentional.com/podcast

Thank you for joining us for another great episode! If you’re enjoying the show, please LEAVE A RATING OR REVIEW, and be sure to hit that subscribe button so you do not miss an episode.

Kicking off the year with a bang on Episode 59 of Witcha Black Ads! This time, we talk Tiger’s bold move away from Nike, Megan Thee Stallion’s collaboration with Planet […]

Copyright Blackpodcasting 2025