Stop Paying Your Credit Card On The Wrong Day!

Many think paying your credit cards by the payment date is enough, but your credit score might not reflect it as expected. The timing of your credit card payment is […]

play_arrow

play_arrow

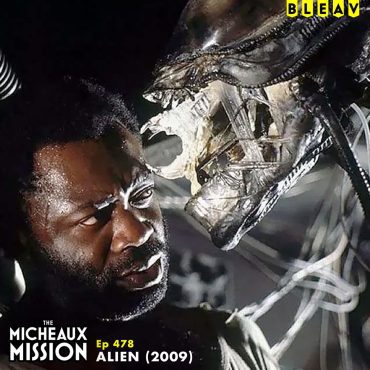

Alien (1979) podcast

play_arrow

play_arrow

K. Miller – 2.25.26 podcast

play_arrow

play_arrow

Game-Changing Marriage Wisdom From the 2026 MIC Marriage Conference, Part 1 podcast

play_arrow

play_arrow

Ep. 226 “Why Being Blocked Hurts So Much (Even When You Don’t Want Them Back) podcast

play_arrow

play_arrow

Tombstone – 2.24.26 podcast

1996 Hip Hop Series: Jason England on Biggie’s Blueprint: The Hidden Impact on Jay-Z & Nas | 02.24 podcast

The New Rules of Investor Credibility with Dominic Forth, Ep. 781 podcast

play_arrow

play_arrow

Ben Michel is the founder and principal of Ridgeview Property Group, a real estate investment firm focused on value-add multifamily properties in the Twin Cities. After a decade as a multifamily broker, Ben transitioned into investing during the pandemic and has since grown Ridgeview’s portfolio to $25 million in assets. He specializes in heavy-lift renovations using construction debt, transforming underperforming properties into long-term holds that generate stable returns.

Make sure to download our free guide, 7 Questions Every Passive Investor Should Ask, here.

Key Takeaways

A decade as a broker provided Ben with credibility and deal-analysis skills that investors trusted.

Raising capital requires confidence, credibility, and broad connections—not just a handful of close contacts.

Expanding his outreach from 50 contacts to thousands transformed his ability to raise funds.

Coaching and mentorship were critical for learning construction loans, renovations, and repositioning strategies.

Long-term success depends on planning for market cycles with reserves, staggered debt maturities, and strong operations.

Topics

From Broker to Investor

Ten years as a multifamily broker built experience analyzing deals and observing operators.

First investment came from converting a failed listing into a purchase with an investor partner during Covid.

Early Capital Raising Lessons

First deal funded by a single $1 million investor—a stroke of luck.

Learned the hard way that a tiny investor list made future raises difficult.

Expanded his outreach by adding thousands of past contacts to his newsletter, enabling a $2.2M raise.

Mentorship and Scaling

Immediately hired a mentor to learn construction debt, repositioning, and property branding.

Shifted from “softball” deals to larger renovations requiring professional systems.

Twin Cities Market Strategy

Avoids restrictive areas like St. Paul (rent control) and focuses on stable suburbs.

Considered Nashville and Bentonville but doubled down locally due to his network and knowledge.

Value-Add Execution

Renovates 1960s–70s properties with $18–25K per-unit budgets.

Upgrades include flooring, cabinets, granite, stainless appliances, dishwashers, and modern lighting.

Strategy creates long-term, easier-to-manage assets with better tenant profiles.

📢 Announcement: Learn about our Apartment Investing Mastermind here.

Round of Insights

Failure that set Ben up for success: Jumping into his first duplex without guidance or capital taught him the value of mentorship.

Digital or mobile resource: X (formerly Twitter) — bookmarking threads from operators sharing multifamily insights.

Book recommendation: Elon Musk by Walter Isaacson.

Daily habit: Visualizing goals, from office setup to portfolio growth, to drive daily focus.

#1 insight for scaling a multifamily portfolio: Market cycles are inevitable—plan ahead with reserves and staggered debt maturities.

Favorite restaurant in Minneapolis, MN: World Street Kitchen.

Next Steps

Connect with Ben on LinkedIn

Subscribe to his newsletter for multifamily updates and deal insights

Thank you for joining us for another great episode! If you’re enjoying the show, please LEAVE A RATING OR REVIEW, and be sure to hit that subscribe button so you do not miss an episode.

Many think paying your credit cards by the payment date is enough, but your credit score might not reflect it as expected. The timing of your credit card payment is […]

Copyright Blackpodcasting 2025