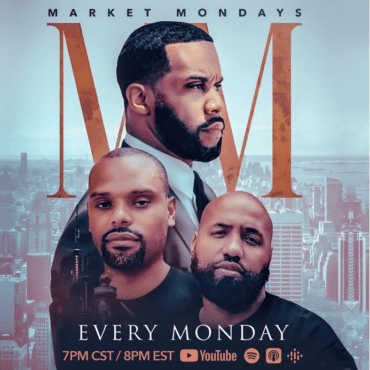

MM # 289: Emotional Investor Lesson: Best Crypto Stock, AI Investments & Business Blueprint w/ Derrick Hayes

This week on Market Mondays we’re getting tactical and long-term: your futures trading tip of the week, the biggest mistakes younger investors make chasing fast wins, and the most important […]