-

play_arrow

-

play_arrow

Up on Game: Hour 2 – Cuffs The Legend, Mahomes Future podcast

-

play_arrow

-

play_arrow

-

play_arrow

-

play_arrow

-

play_arrow

Trump DOJ Releases Trove Of Heavily Redacted Epstein Files podcast

-

play_arrow

The Arrington Gavin Show Ep. 485 “AUSTRALIA’S SOCIAL MEDIA BAN” podcast

-

play_arrow

Muscle Marvin – 12.19.25 podcast

-

play_arrow

- Home

- keyboard_arrow_right Entrepreneur

- keyboard_arrow_rightPodcasts

- keyboard_arrow_rightBusiness

- keyboard_arrow_right Trump’s Prescription Drug Order, Amazon’s AMD Power Play & Future of Healthcare Stocks

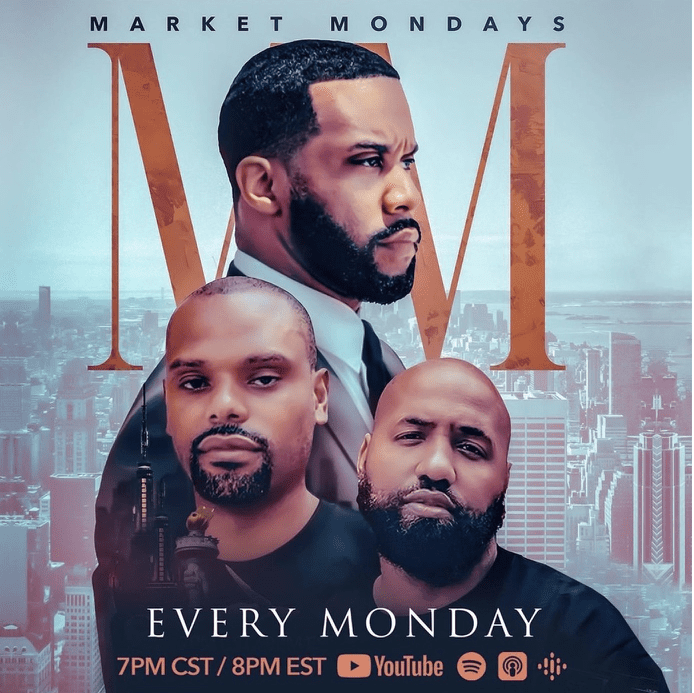

Trump’s Prescription Drug Order, Amazon’s AMD Power Play & Future of Healthcare Stocks

In this insightful Market Mondays clip, Rashad Bilal, Ian Dunlap, and Troy Millings break down two of the week’s biggest financial headlines that could shake up the markets: President Trump’s executive order to lower prescription drug prices and Amazon’s strategic acquisition of AMD shares.

First, the hosts dive deep into the possible long-term impacts of Trump’s new executive order aiming to slash prescription drug costs across the board. They discuss the potential winners—everyday consumers in need of lower medication costs—and the possible losers, notably major pharmaceutical companies that may see profit margins squeezed. The conversation covers how this move could spur much-needed innovation within the healthcare sector, but also draws attention to challenges such as lobbying pressure and lengthy litigation. What does this mean for healthcare stocks like Pfizer, Eli Lilly, Novo Nordisk, Johnson & Johnson, CVS, Amgen, and more? The hosts lay out possible outcomes and the bigger economic picture, including references to Mark Cuban’s earlier ideas about drug pricing and fair access.

Next up, the crew unpacks the real story behind Amazon’s much-discussed “purchase” of $84 million in AMD shares. Is this a direct investment or the result of AMD’s acquisition of ZT Group International—where Amazon already had stakes? They clarify the technical details and examine how this plays into Amazon’s push for self-reliance in AI infrastructure and chip development, following in the footsteps of giants like Apple making their own chips. The discussion also touches on how this integration of hardware and internal resources could position Amazon for even more dominance in the AI race and tech industry at large.

Throughout the clip, Rashad, Ian, and Troy provide honest takes on market strategies, investment insights, and the political chess game playing out in real time. From healthcare innovation to tech self-sufficiency, this conversation is a must-watch for investors, entrepreneurs, and anyone wanting to stay ahead of the curve on Wall Street.

Don’t forget to like, comment, and subscribe for more in-depth market analysis and actionable insights!

#MarketMoves #PrescriptionDrugs #HealthcareStocks #TrumpNews #Amazon #AMD #TechStocks #AI #Investing #StockMarket #Finance #BusinessNews #MarkCuban #Pharma #EliLilly #Pfizer #JohnsonAndJohnson #Pharmaceuticals #Innovation #BusinessAnalysis #AmazonPrime #WallStreet #FinancialNews

Our Sponsors:

* Check out PNC Bank: https://www.pnc.com

* Check out Square: https://square.com/go/eyl

Support this podcast at — https://redcircle.com/marketmondays/donations

Advertising Inquiries: https://redcircle.com/brands

Privacy & Opt-Out: https://redcircle.com/privacy

Site Search

Copyright Blackpodcasting 2025