Cliff Notes: How to Utilize Watch Time & Maximize Earnings

In this episode, we dive into the importance of watch time and its impact on lead generation and sales. Vince Reed shares valuable insights on leveraging watch time to create […]

play_arrow

play_arrow

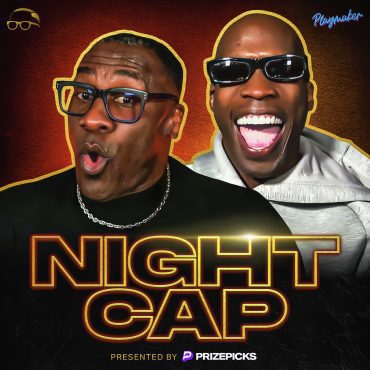

Morning Maddhouse: Wednesday Maddhouse ReCap (02/11/26) podcast

play_arrow

play_arrow

Best of Super Bowl LX Part 1: Seahawks WIN + Bad Bunny Halftime Show podcast

play_arrow

play_arrow

Best of Super Bowl LX Part 2: Will Campbell being SOFT, Uchenna Nwosu breaks down his Pick 6 podcast

AFTERTHOUGHTS: Carmen Sanders podcast

play_arrow

play_arrow

Deebo & Joe – Part 1: Will Cam Heyward be back? + Steelers Coaching Staff Hires podcast

play_arrow

play_arrow

Deebo & Joe – Part 2: Steelers waiting on Aaron Rodgers decision + Jim Schwartz resigns podcast

play_arrow

play_arrow

Morning Maddhouse: Tuesday Maddhouse ReCap (02/10/26) podcast

play_arrow

play_arrow

In this eye-opening episode, Troy Millings sits down with Thasunda Brown Duckett, the CEO of TIAA, to discuss the importance of retirement planning, particularly for young adults facing challenges such as inflation, student loan debt, and mortgage rates. Thasunda shares invaluable insights on why and when young adults should start thinking about retirement, emphasizing the power of compounding and the significance of maximizing retirement benefits from the very first job.

Thasunda stresses the need for young adults to have a clear vision of their financial future and to make strategic decisions early in their careers. Drawing from her personal experience and the challenges faced by her own family, she encourages viewers to shift their mindset from short-term gratification to long-term wealth-building. Thasunda reminds us that retirement planning is not just about securing our own future, but also about the legacy we leave for our children and generations to come.

Throughout the conversation, she provides practical advice on maximizing retirement benefits, understanding tax strategies, and effectively managing student loan debt. Thasunda emphasizes the importance of having a clear game plan for financial decisions, including investing in stocks and bonds, building a rainy day fund, and making sound budgeting choices.

With a passionate and relatable approach, Thasunda acknowledges the aspirations of young adults and reaffirms their desire for long-term financial stability. She addresses the misconceptions about young people's attitudes towards retirement planning and emphasizes the need to present information in a relatable and accessible manner.

Don't miss this compelling discussion that challenges conventional notions about retirement planning and encourages viewers to take charge of their financial futures. Join us as we navigate the complexities of financial planning with Thasunda Brown Duckett, and gain valuable insights that will shape your approach to retirement and financial security. Let's secure the bag today and compound the bag tomorrow!

#RetirementPlanning #FinancialSecurity #WealthBuilding #LongTermVision #TIAA #InvestingInYourself #GenerationalWealth #StudentLoanDebt #MaximizingRetirementBenefits #TaxStrategies #EYL #EYLMedium #ThasundaBrownDuckett #TroyMillings

Our Sponsors:

* Check out Kajabi and use my code EARN for a great deal: https://kajabi.com/

* Check out Kajabi and use my code EARN for a great deal: https://kajabi.com/

* Check out undefined: undefined

Advertising Inquiries: https://redcircle.com/brands

Privacy & Opt-Out: https://redcircle.com/privacy

In this episode, we dive into the importance of watch time and its impact on lead generation and sales. Vince Reed shares valuable insights on leveraging watch time to create […]

Copyright Blackpodcasting 2025